Reading a pay stub worksheet answers – Navigating a pay stub worksheet can be a daunting task, but with the right guidance, you can unlock its secrets and gain valuable insights into your financial well-being. This comprehensive guide provides answers to all your questions, empowering you to decipher the complexities of your pay stub and make informed financial decisions.

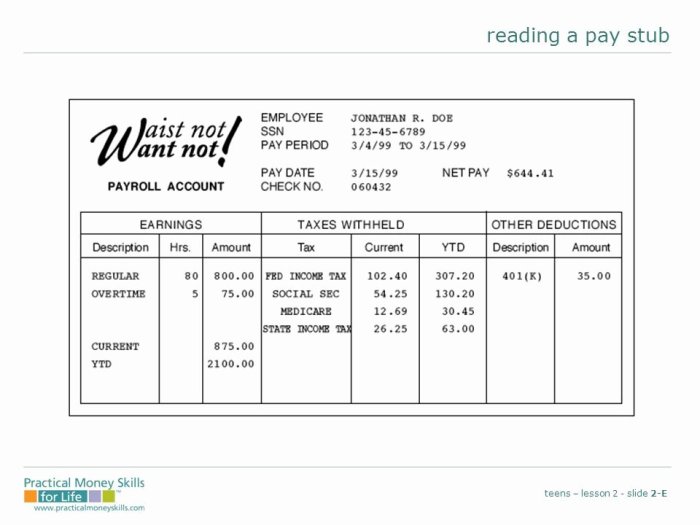

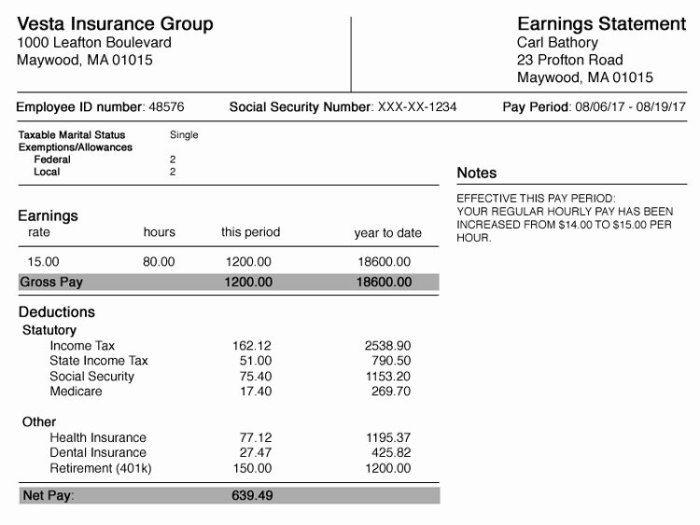

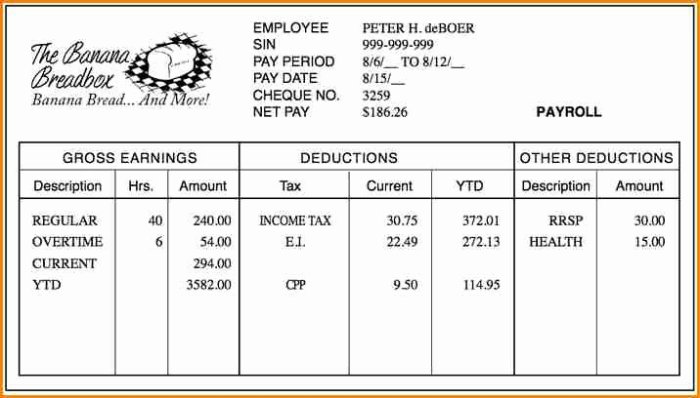

Understanding the components of a pay stub worksheet is crucial for accurate analysis. Essential sections include gross pay, net pay, deductions, and taxes. Identifying these elements is the key to extracting meaningful information from your pay stub.

Understanding a Pay Stub Worksheet

A pay stub worksheet is a valuable tool that helps employees understand their earnings, deductions, taxes, and net pay. It provides a comprehensive breakdown of an employee’s compensation, allowing them to track their income and expenses more effectively.

Typically, a pay stub worksheet includes the following sections:

- Gross Pay

- Earnings

- Deductions

- Taxes

- Net Pay

Identifying Key Information: Reading A Pay Stub Worksheet Answers

To effectively use a pay stub worksheet, it is essential to identify the key information it contains. These include:

- Gross Pay:Total amount of earnings before any deductions or taxes.

- Earnings:Details of how gross pay is earned, including regular pay, overtime, bonuses, and other forms of compensation.

- Deductions:Pre-tax and post-tax amounts withheld from gross pay, such as health insurance premiums, retirement contributions, and union dues.

- Taxes:Federal, state, and local taxes withheld from gross pay, including income tax, Social Security tax, and Medicare tax.

- Net Pay:Amount of pay that remains after all deductions and taxes have been subtracted from gross pay.

Analyzing Earnings and Deductions

Earnings on a pay stub worksheet can vary depending on the type of work performed and the employee’s pay structure. Common types of earnings include:

- Regular Pay:Hourly or salaried compensation for regular work hours.

- Overtime Pay:Additional compensation for hours worked beyond regular work hours.

- Bonuses:One-time or periodic payments for exceptional performance or achievements.

Deductions, on the other hand, are amounts withheld from gross pay. Common categories of deductions include:

- Pre-tax Deductions:Withheld before taxes are calculated, reducing taxable income. Examples include health insurance premiums and retirement contributions.

- Post-tax Deductions:Withheld after taxes are calculated. Examples include union dues and charitable contributions.

Calculating Net Pay

Net pay is calculated by subtracting total deductions and taxes from gross pay. The formula for calculating net pay is:

Net Pay = Gross Pay

- Total Deductions

- Total Taxes

For example, if an employee has a gross pay of $1,000, total deductions of $100, and total taxes of $200, their net pay would be $700.

Reviewing Taxes and Withholdings

Pay stub worksheets typically include a breakdown of taxes and withholdings, which are deducted from gross pay. Common types of taxes and withholdings include:

- Income Tax:Tax on earned income, calculated based on tax brackets.

- Social Security Tax:Tax used to fund retirement and disability benefits.

- Medicare Tax:Tax used to fund health insurance for the elderly and disabled.

The amount of taxes and withholdings deducted is determined by the employee’s income, filing status, and number of allowances claimed.

Using a Pay Stub Worksheet for Budgeting

Pay stub worksheets can be valuable tools for budgeting and financial planning. By analyzing income and expenses, employees can gain a better understanding of their financial situation and make informed decisions about spending and saving.

To use a pay stub worksheet for budgeting, follow these steps:

- Review your pay stub worksheet to identify your net pay, deductions, and expenses.

- Categorize your expenses into fixed (rent, mortgage, car payment) and variable (groceries, entertainment, gas).

- Create a budget that allocates your net pay to essential expenses, savings, and discretionary spending.

- Track your expenses regularly to ensure you are staying within your budget.

Common Errors and Troubleshooting

When using a pay stub worksheet, it is important to be aware of common errors that may occur. These errors can include:

- Incorrectly Calculating Gross Pay:Ensure that all earnings are included in the calculation.

- Missing Deductions:Verify that all pre-tax and post-tax deductions are accounted for.

- Inaccurate Tax Withholdings:Check that the number of allowances claimed is correct and that the tax brackets are applied properly.

To troubleshoot errors, carefully review your pay stub worksheet and compare it to your pay statement. If you find any discrepancies, contact your employer or payroll department for clarification.

Essential Questionnaire

Q: What is the purpose of a pay stub worksheet?

A: A pay stub worksheet serves as a tool to organize and interpret information from your pay stub, providing a clear understanding of your earnings, deductions, and net pay.

Q: How do I calculate my net pay?

A: Net pay is calculated by subtracting deductions from your gross pay. Deductions include taxes, health insurance, and retirement contributions.

Q: What are common errors to avoid when using a pay stub worksheet?

A: Common errors include misinterpreting earnings and deductions, incorrect calculations, and overlooking important information.