The H&R Block Final Exam Answer 2019 serves as an invaluable resource for students seeking to excel in their final examination. This comprehensive guide delves into the intricacies of the exam, providing a thorough understanding of its format, content, and effective preparation strategies.

The exam encompasses a wide range of topics, including tax laws, accounting principles, and financial planning. Understanding these concepts is crucial for success on the exam. Moreover, effective time management and question selection techniques are essential for maximizing performance.

Final Exam Overview: H&r Block Final Exam Answer 2019

The H&R Block final exam 2019 is a comprehensive assessment designed to evaluate candidates’ knowledge and skills in the field of taxation. It plays a crucial role in determining an individual’s eligibility for certification as a tax professional with H&R Block.

The exam consists of multiple-choice questions covering various aspects of taxation, including federal income tax, state income tax, payroll tax, and estate tax. It is administered in a timed environment, typically lasting for several hours.

Exam Format

- Multiple-choice questions

- Timed exam (duration varies)

- Covers various taxation topics

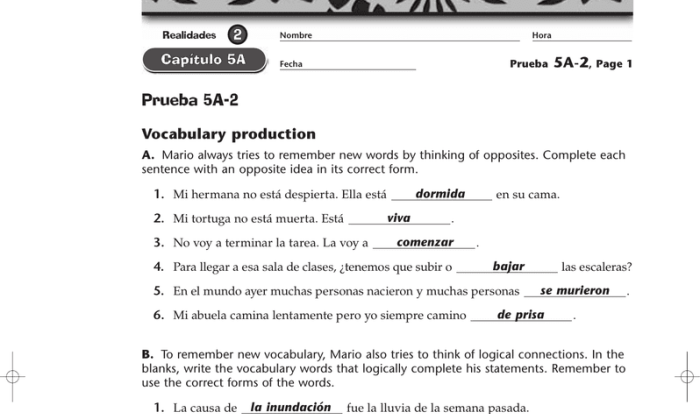

Exam Content

The H&R Block Final Exam is a comprehensive assessment that evaluates candidates’ knowledge and skills in various aspects of tax preparation. It covers a wide range of topics, including tax laws, tax forms, and tax preparation software.

The exam is designed to test candidates’ understanding of the following key concepts:

- Federal and state tax laws

- Tax forms and schedules

- Tax preparation software

- Tax planning and strategies

- Ethics and professional conduct

Specific Subject Areas Tested

The exam covers the following specific subject areas:

- Individual income tax

- Business income tax

- Estate and gift tax

- Payroll tax

- Sales and use tax

- Property tax

Exam Preparation

Effective exam preparation requires a structured approach to maximize understanding and retention. Implementing effective study strategies, time management techniques, and utilizing helpful resources can significantly enhance your performance on the final exam.

Study Strategies

- Spaced Repetition:Reviewing material at increasing intervals strengthens memory recall.

- Active Recall:Regularly test yourself on the material without looking at your notes to identify areas needing reinforcement.

- Interleaving:Mix up different topics while studying to improve comprehension and retention.

- Elaboration:Explain concepts to yourself or others to enhance understanding and retention.

Time Allocation

Allocate study time wisely, considering the difficulty and weight of each topic. Use a study schedule to plan your sessions and stick to it as much as possible.

Study Resources

- Course Notes and Textbooks:Review your notes and textbooks thoroughly, focusing on key concepts and examples.

- Practice Exams and Quizzes:Attempt practice exams and quizzes to familiarize yourself with the exam format and identify areas for improvement.

- Online Resources:Utilize online resources such as videos, simulations, and discussion forums to supplement your understanding.

- Study Groups:Form study groups with classmates to discuss concepts, clarify doubts, and reinforce learning.

Exam-Taking Strategies

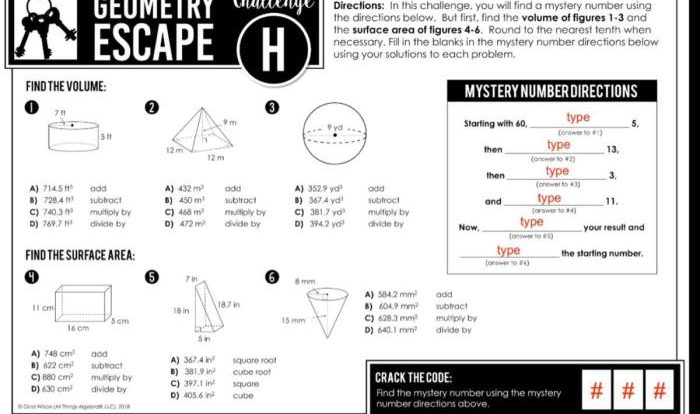

Exam-taking strategies play a pivotal role in maximizing performance and achieving success on the H&R Block Final Exam. Effective techniques encompass time management, question selection, and answer writing.

Time management is crucial. Allocate time wisely by understanding the exam’s duration and the number of questions. Prioritize questions based on their difficulty and point value. Begin with questions you are most confident in, ensuring you have sufficient time for the more challenging ones.

Question Selection

Carefully read each question before selecting an answer. Identify s and understand the specific requirements of the question. Eliminate obviously incorrect answers and focus on those that align with the question’s intent.

Answer Writing

Provide clear and concise answers. Support your responses with relevant examples or explanations. Use proper grammar and punctuation, as errors can impact your score. If unsure about an answer, make an educated guess rather than leaving it blank.

Answer Analysis

Examining sample questions from the final exam provides valuable insights into the exam’s structure, content, and difficulty level. By analyzing these questions, candidates can identify common patterns, assess their strengths and weaknesses, and develop effective strategies for exam preparation.

The final exam covers a comprehensive range of topics, including tax law, accounting principles, and financial planning. Sample questions provide a representative cross-section of these topics, enabling candidates to gauge their understanding of the subject matter and pinpoint areas requiring further study.

Correct Answer Rationales, H&r block final exam answer 2019

Detailed explanations and rationales for the correct answers are crucial for solidifying understanding and avoiding common pitfalls. These rationales should clearly articulate the reasoning behind the correct answer, citing relevant tax codes, accounting standards, or financial planning principles.

Incorrect answers should also be discussed, highlighting the misconceptions or errors that led to the wrong conclusion. This analysis helps candidates avoid similar mistakes during the actual exam.

Common Pitfalls and Misconceptions

Identifying common pitfalls and misconceptions is essential for exam preparation. Sample questions can reveal areas where candidates are likely to encounter difficulties or misunderstandings.

By understanding these pitfalls, candidates can focus their study efforts on addressing them. This proactive approach minimizes the risk of making preventable errors during the exam.

Exam Performance Evaluation

Evaluating exam performance is crucial for identifying areas of strength and weakness. By analyzing your results, you can develop targeted strategies to improve your knowledge and skills.

To effectively evaluate your exam performance, consider the following steps:

Review Exam Questions

- Thoroughly review the exam questions and your responses.

- Identify questions you answered correctly and incorrectly.

- Analyze the reasons for incorrect answers, such as misunderstandings, knowledge gaps, or careless mistakes.

Identify Knowledge Gaps

- Based on the questions you answered incorrectly, pinpoint specific areas where your knowledge is lacking.

- Note down the concepts, theories, or skills you need to strengthen.

Set Realistic Goals

- Establish realistic goals for improving your knowledge and skills.

- Break down large goals into smaller, manageable steps.

- Prioritize the areas where you need the most improvement.

Track Progress

- Regularly track your progress towards achieving your goals.

- Use study plans, to-do lists, or progress trackers to monitor your efforts.

li>Adjust your strategies as needed based on your progress.

Question & Answer Hub

What is the format of the H&R Block Final Exam 2019?

The exam consists of multiple-choice questions, short answer questions, and case studies.

How can I effectively prepare for the exam?

Begin studying early, allocate ample time for each subject area, and utilize practice questions and mock exams.

What are some common pitfalls to avoid during the exam?

Avoid rushing through the exam, carefully read the instructions for each question, and manage your time wisely.